Tokenomics

Similar supply & halving schedule as Bitcoin

BSOV Token takes the deflationary aspect further than Bitcoin by following approximately the same halving schedule as Bitcoin and adding a deflationary burning mechanism for every on-chain transaction that is made. 1% of every BSOV transaction is burned and destroyed, never to come into circulation again.

You are incentivized to hold BSOV Tokens, because you are disincentivized to send them.

You should be careful not to send BSOV too often, because BSOV Token is not intended for day-to-day transactions like a normal FIAT currency or even BTC. 1% of each BSOV-transaction is destroyed forever, so only the remaining 99% will end up at the receivers address.

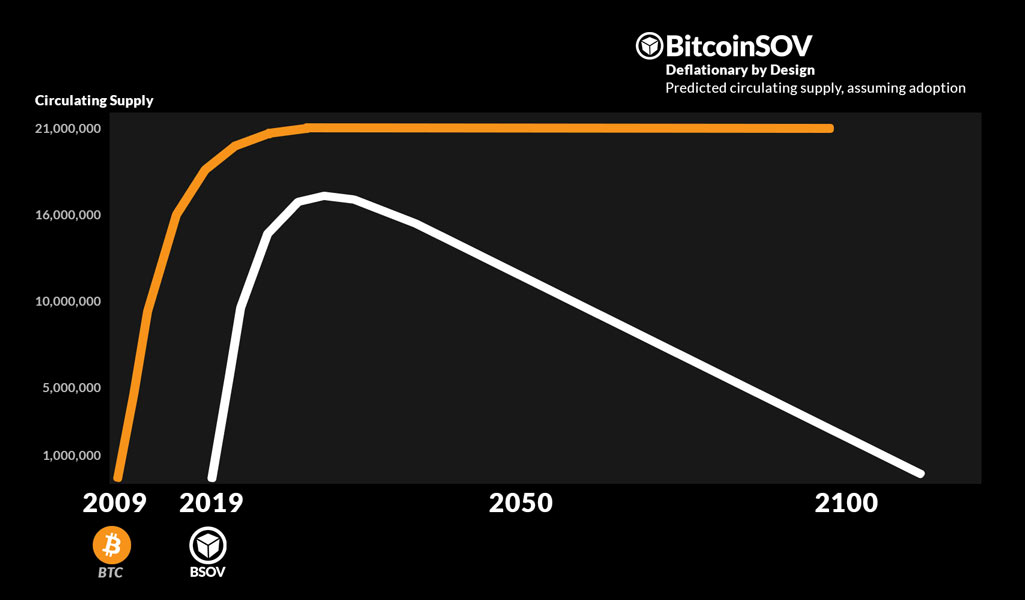

Deflationary by Design

The 1% transaction burn makes BSOV Token deflationary by design compared to the original Bitcoin (BTC), therefore stimulating supply scarcity and reducing token velocity. In the graph below, you can see a comparison between the predicted circulating supply of BTC and BSOV. The white line (BSOV) is destined to become scarce after many years of usage. This graph assumes consistent adoption.

Reduced Token velocity

One of the primary effects of the deflationary mechanism in BSOV, is that token velocity is reduced. Token velocity is described as “number of times a token changes hands.” [external link]. According to the representation “Token velocity x Market cap = Total transaction value”, a lower token velocity may result in a higher token price.

One of the main problems which BSOV aims to solve, is the Token Velocity Problem. The problem is basically that many cryptocurrencies have no incentives for the token holders to hold the token for long periods of time. The token holders are rather incentivized to sell their token for other tokens which are better suited as a store-of-value (SoV). Many other cryptocurrencies are not solving this problem – therefore reducing their token price.

Distributed by work – Intrinsic value

BSOV is the first deflationary cryptocurrency which is mineable – meaning all BSOV tokens are only distributed by proof-of-work (PoW) a.k.a computational calculations provided by physical hardware. BSOV had no huge airdrops, or development-subsidies, dev fees or premined tokens. This may ensure that the adopters of BSOV are most likely high-quality and committed community members, compared to those tokens who give away all their tokens for free. The mining feature helps give BSOV intrinsic value, since there has to be work and money involved to produce tokens.

Held by committed volunteers

BSOV has a high ratio of committed volunteers who have already timelocked their BSOV tokens by using SovCube. This feature was created for community members to show their commitment to the longevity of BSOV. As a result, this feature may also help reduce token velocity, and it will also help to communicate the integrity of BSOV token holders.